That nagging feeling as the year winds down, wondering if you've spent every last dime in your Flexible Spending Account (FSA) before it vanishes forever? You're not alone. The "use-it-or-lose-it" rule is perhaps the most notorious of the FSA downsides and 'use-it-or-lose-it' rules, striking fear into the hearts of even the most meticulous budgeters. But what if understanding these rules meant you could turn that fear into financial savvy, ensuring every pre-tax dollar you set aside actually works for you?

This comprehensive guide cuts through the jargon, helping you navigate the complexities of your FSA. We'll explore the pitfalls, uncover the hidden advantages, and arm you with the strategies you need to maximize your benefits and minimize the dreaded forfeiture.

At a Glance: Your FSA Fast Facts

- Pre-Tax Savings: FSAs allow you to set aside pre-tax money for eligible healthcare expenses, reducing your taxable income.

- The "Use-It-or-Lose-It" Trap: Unspent funds at year-end are typically forfeited to your employer, with limited exceptions.

- Annual Limits: The IRS sets annual contribution limits (e.g., $3,300 per employer for 2024), which can change yearly.

- Fixed Contributions: Your elected amount is generally fixed for the plan year unless you experience a qualifying life event.

- Eligible Expenses: Covers a range of medical, dental, and vision costs for you, your spouse, and dependents. OTC meds usually require a prescription.

- Mitigation Options: Some employers offer a small carryover amount (e.g., up to $680 for 2026 plan years) or a grace period (up to 2.5 months) to spend funds.

- Leaving Your Job: You typically forfeit unused funds upon leaving, but the Uniform Coverage rule protects you if you spent more than you contributed.

- No Tax Reporting: Health Care FSA contributions are not reported on your personal income tax return.

The Promise & The Peril: Understanding Your FSA

A Flexible Spending Account (FSA) can feel like a financial superpower. Imagine setting aside money for healthcare costs before taxes are even calculated, effectively lowering your taxable income. That's the core promise of an FSA: a dedicated, tax-advantaged fund for eligible medical, dental, and vision expenses not covered by your insurance. This includes everything from copayments and deductibles to prescription medications and even specific over-the-counter (OTC) items. By funding your FSA with pre-tax dollars, your taxable wages decrease, though you can't claim these contributions as a separate tax deduction.

But every superpower has its kryptonite, and for the FSA, it's the infamous "use-it-or-lose-it" rule. This single stipulation is the primary source of anxiety for many FSA holders, and for good reason. It dictates that any funds you contribute to your FSA that aren't spent by the end of your plan year — or within any employer-provided grace period — are simply forfeited. They don't roll over (unless your employer offers a specific carryover option), they don't get refunded, and they certainly don't go into your pocket. They revert to your employer.

This rule demands a degree of foresight and planning that's often at odds with the unpredictable nature of healthcare. Overestimate your needs, and you risk losing money. Underestimate, and you miss out on potential tax savings. It's a tightrope walk that requires a strategic approach.

Beyond Forfeiture: Other Not-So-Flexible Aspects of FSAs

While the "use-it-or-lose-it" rule hogs the spotlight as the biggest of the FSA downsides and 'use-it-or-lose-it' rules, it's not the only factor that limits the flexibility of these accounts. Understanding these additional constraints is crucial for making informed decisions about your contributions.

Contribution Limits and Fixed Decisions

The IRS sets annual limits on how much you can contribute to a Health Care FSA. For example, for 2024, this limit is $3,300 per year, per employer. If both you and your spouse have access to FSAs through your respective employers, you can each contribute up to this limit to your separate accounts. These limits are subject to change annually, so it's wise to check the current figures when making your enrollment decisions.

Perhaps even more restrictive is the fact that your contribution decisions are generally fixed for the entire plan year. Once you elect an amount during open enrollment, you typically can't change it unless you experience a qualifying life event. These events often include marriage, divorce, birth or adoption of a child, or a change in employment status for you or your spouse. Without such an event, you're locked into your initial election, making that initial estimate all the more critical.

Navigating Eligible Expenses: What Qualifies (and What Doesn't)

Another area where FSAs can feel less than "flexible" is in their definition of eligible expenses. While they cover a broad range of common healthcare costs, there are specific rules and exclusions that can catch people off guard.

Generally, eligible expenses include:

- Medical: Doctor visits, specialist fees, hospital stays, lab tests, X-rays, chiropractic care, acupuncture.

- Dental: Cleanings, fillings, orthodontia, dentures.

- Vision: Eye exams, glasses, contact lenses, laser eye surgery.

- Prescription Medications: Any drug requiring a prescription.

However, the devil is in the details, particularly with over-the-counter items and non-medical services: - Over-the-Counter (OTC) Medicines and Drugs: While many common OTC medications (like pain relievers, allergy meds, cold remedies) are now eligible, they often require a prescription from a doctor to be covered by your FSA. This means you can't just grab them off the shelf and pay with your FSA card; you'll likely need to get a doctor's note for reimbursement.

- Everyday Essentials: Items like regular diapers for newborns and infants, while essential for child-rearing, are not considered eligible medical expenses. Only specialized medical diapers for specific conditions would qualify.

- Wellness and Fitness: Gym memberships are generally not eligible FSA expenses. The only exception is if a doctor explicitly deems fitness medically necessary for the treatment of a specific medical condition (e.g., obesity, heart disease) and provides a Letter of Medical Necessity.

- Cosmetic Procedures: Expenses purely for cosmetic purposes are typically excluded.

This strict definition means you need to be mindful of what you're purchasing. Always check with your plan administrator or the IRS guidelines if you're unsure about an expense, as attempting to claim ineligible items can lead to headaches and potential penalties.

Softening the Blow: Employer-Provided Safeguards

The "use-it-or-lose-it" rule is a standard IRS regulation, but employers aren't entirely powerless to mitigate its harshness. The IRS allows companies to offer one of two options to give employees a bit more breathing room. It's crucial to understand that your employer can only offer one of these, not both.

The Carryover Option

This rule allows you to carry over a limited amount of unspent FSA funds from one plan year into the next. For plan years ending in 2026, for example, the maximum carryover amount is $680. This means if you have $680 or less left at the end of your plan year, that money doesn't disappear; it rolls into your FSA balance for the following year, ready to be used for new eligible expenses.

The carryover option is a significant benefit because it reduces the pressure to "spend down" every last dollar frantically at year-end. It provides a valuable buffer against misestimation, acknowledging that healthcare needs are not always predictable. However, remember that any amount above the carryover limit will still be forfeited.

The Grace Period

Alternatively, your employer might offer a grace period. This option extends the time you have to incur and pay for eligible expenses from your current plan year's FSA funds. The maximum grace period allowed by the IRS is up to 2.5 months after the end of the plan year.

For example, if your plan year ends on December 31st, a grace period could extend your spending window until March 15th of the following year. During this grace period, you can use your remaining FSA funds to pay for new eligible expenses incurred within that extended timeframe. It's essentially a temporary extension of your FSA's availability.

Confirming Your Employer's Policy

The critical takeaway here is that these mitigation options are employer-dependent. You cannot assume your plan offers one or the other. You absolutely must confirm the specific rules of your FSA with your employer's benefits administrator or by reviewing your plan documents. This information is typically available during open enrollment or through your company's HR portal. Knowing whether you have a carryover, a grace period, or neither, profoundly impacts your year-end spending strategy.

When Life Changes: What Happens to Your FSA Funds

Life is unpredictable, and sometimes, circumstances like changing jobs or unexpected medical expenses arise. How your FSA interacts with these events is another key aspect of its limitations and benefits.

Leaving Your Job: A Race Against the Clock

One of the most significant "use-it-or-lose-it" scenarios occurs when you leave your company. Generally, if you resign or are terminated, your eligibility to use your FSA funds ends on your last day of employment. This means any unspent money remaining in your account typically reverts to your employer.

Strategy: If you anticipate leaving your job, make a concerted effort to use your FSA funds before your departure date. Schedule any pending doctor appointments, fill prescriptions, get new glasses or contacts, or stock up on eligible OTC items (remembering the prescription rule for many). It's a good idea to confirm your exact termination date and the final date you can incur expenses with your HR department.

The Uniform Coverage Rule: A Hidden Advantage

Here's a little-known silver lining amidst the FSA downsides: the Uniform Coverage Rule. This IRS rule states that employers cannot ask for money back that was spent from your FSA, even if you've spent more than you've contributed by the time you leave the company.

Let's say you elected to contribute $2,000 to your FSA for the year. On January 15th, you have an unexpected medical emergency and use $1,800 from your FSA. By the time you leave your job on February 15th, you've only contributed $166.67 through payroll deductions (assuming a bi-weekly pay schedule). Even though you've "overspent" your contributions by over $1,600, your employer cannot ask you to repay that difference. This rule provides a significant benefit for individuals who face large, early-year medical expenses. However, any unused funds in your account upon leaving do still return to the employer.

Strategic Contributions: Avoiding Over- or Under-Funding

The core challenge with an FSA is predicting your healthcare costs. Over-contribute, and you risk forfeiture. Under-contribute, and you miss out on tax savings and valuable pre-tax funds for your expenses. The goal is to hit that "sweet spot."

Calculating Your Needs: A Practical Guide

When open enrollment rolls around, take a systematic approach to estimating your upcoming year's expenses:

- Review Past Year's Expenses: Look at your medical, dental, and vision spending from the previous 12-24 months. How much did you pay in copays, deductibles, prescription costs, and out-of-pocket expenses for glasses, contacts, or dental work?

- Anticipate Upcoming Needs:

- Planned Procedures: Do you know you'll need new glasses, contacts, dental crowns, or orthodontia? Factor in those costs.

- Chronic Conditions: If you have chronic conditions, estimate regular prescription refills and specialist visits.

- Family Changes: Are you expecting a baby? Factoring in prenatal care, delivery costs (even if covered by insurance, you'll have deductibles/copays), and postnatal care is crucial. While regular diapers aren't eligible, many other items are.

- Doctor Visits: How many primary care or specialist visits do you typically have in a year? Multiply by your copay.

- Factor in Insurance Changes: Did your insurance plan change? New deductibles, copays, or out-of-pocket maximums will impact your needs.

- Consider OTC Needs: If you regularly buy eligible OTC items (remembering the prescription rule for many), factor those into your estimate.

Contribution Guidance:

- High Expenses: If your out-of-pocket medical bills typically amount to $221 or more per month (approximately $2,650 per year), contributing the maximum FSA limit might be a smart move to capture all available tax savings.

- Moderate Expenses: For lower, more predictable expenses, contributing the total of your approximate copays, dental, and vision expenses for the upcoming year is often sufficient. Aim for a conservative estimate that you're confident you'll spend.

Is an FSA Right for You? Making the Decision

While FSAs offer undeniable tax advantages, they're not a perfect fit for everyone. Weigh the benefits against the FSA downsides and 'use-it-or-lose-it' rules to determine if it's the right choice for your financial and healthcare situation.

An FSA can be useful if:

- You anticipate regular medical, dental, or vision expenses.

- You want to lower your taxable income.

- You need access to the entire annual elected amount from the first day of the plan year, which can be a lifesaver for unexpected large expenses.

An FSA may not be ideal if: - You rarely need medical care and have very few out-of-pocket expenses.

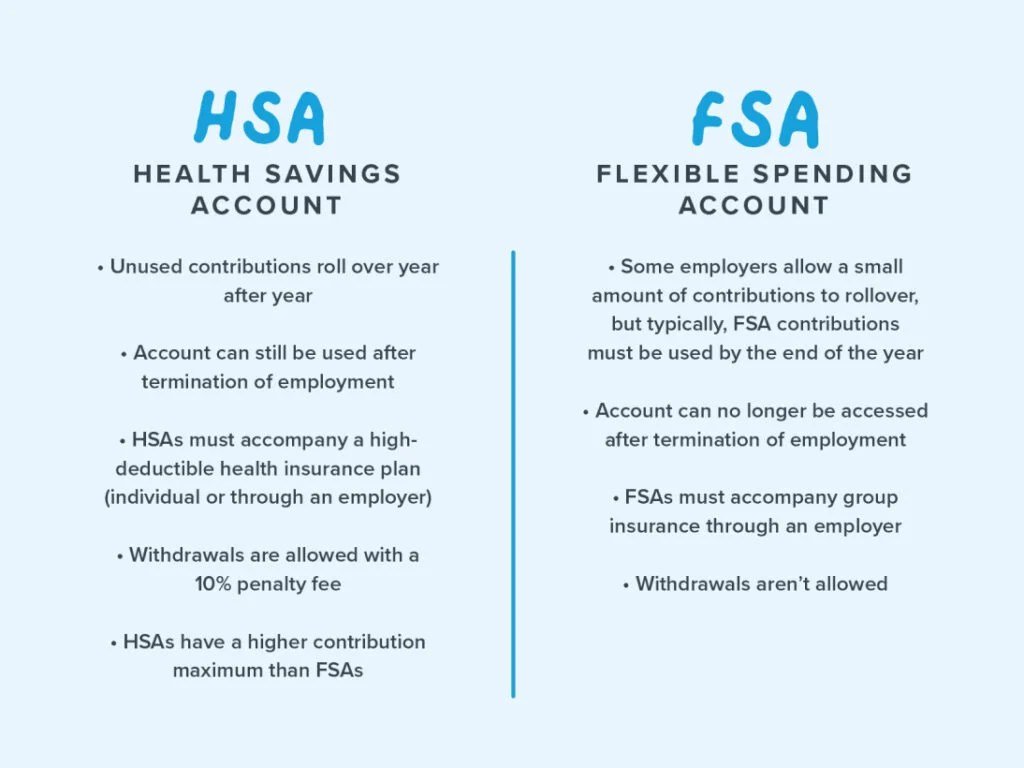

- You qualify for and prefer a Health Savings Account (HSA). HSAs offer more flexibility, long-term growth potential, and funds roll over year-to-year, making them a more robust long-term savings vehicle. For a deeper dive into whether this account is right for you, check out our guide on Is an FSA worth it?.

- You are highly concerned about the "use-it-or-lose-it" rule and find it difficult to accurately estimate your healthcare spending.

When making your decision, consider your personal risk tolerance for potential forfeiture versus the guaranteed tax savings.

Behind the Scenes: Tax Implications and Social Security

Beyond the immediate pre-tax savings, your FSA can have other subtle tax implications worth noting, particularly if you're a high earner.

Pre-Tax Savings & FICA Taxes

When you contribute to an FSA, you're not just reducing your federal income tax liability. You're also reducing your taxable wages for FICA (Federal Insurance Contributions Act) taxes, which include Social Security and Medicare. This means you save a little bit on those taxes too.

For most people, this is an unqualified benefit. However, for employees earning the Social Security maximum taxable salary (e.g., $168,600+ for 2024), lowering your FICA Social Security taxes might slightly reduce your future Social Security benefits, as those benefits are calculated based on your earnings history. This is usually a very minor impact, but it's a detail worth understanding for top earners. The immediate tax savings typically outweigh this potential, slight long-term effect.

No Tax Reporting for You

Unlike some other tax-advantaged accounts, there are no specific reporting requirements for Health Care FSAs on your personal income tax returns. Your employer handles the necessary adjustments to your taxable wages through payroll, so you won't need to report your FSA contributions or distributions when you file your taxes. This simplifies tax season for FSA users.

Common Questions & Misconceptions About FSA Downsides

Navigating FSAs can be tricky, and several common questions and misconceptions often arise, especially concerning the downsides. Let's clarify some of the most frequent ones.

Can I get my money back if I don't use it?

No, generally you cannot. This is the core of the "use-it-or-lose-it" rule. Any unspent funds are forfeited to your employer at the end of the plan year, unless your employer offers a carryover amount or a grace period. There's no mechanism to "cash out" your FSA balance.

Are all medical expenses covered by an FSA?

No, not all medical expenses. While a broad range is covered (doctor visits, prescriptions, dental, vision), certain items like regular diapers, cosmetic procedures, and general gym memberships (unless medically necessary with a doctor's letter) are typically excluded. Over-the-counter medicines often require a prescription. Always check the IRS guidelines and your plan's specific list of eligible expenses.

What if I overspent my FSA and then left my job? Do I owe my employer money?

No, you do not. Thanks to the Uniform Coverage Rule, if you used more from your FSA than you contributed by the time you leave your job, your employer cannot require you to repay the difference. This rule protects employees who incur large medical expenses early in the plan year. However, any unused funds remaining in your account when you leave are forfeited.

Does having an FSA impact my ability to contribute to an HSA?

Generally, yes. You usually cannot contribute to a Health Savings Account (HSA) if you are also covered by a general-purpose Health Care FSA. HSAs require you to be enrolled in a High-Deductible Health Plan (HDHP) and have no other "first-dollar" medical coverage. A general-purpose FSA is considered other medical coverage. However, some employers offer a "Limited Purpose FSA" (for dental and vision only) or a "Post-Deductible FSA" which can be combined with an HSA. Always confirm your specific plan rules.

What's the difference between the carryover and grace period?

The carryover rule allows a specific dollar amount (e.g., up to $680) of unused funds to roll into the next plan year's balance. These funds can then be used for new expenses in the new year. The grace period, on the other hand, extends the deadline to incur and pay for expenses from the current plan year's funds for an additional 2.5 months after the plan year ends. You're still using money from the old plan year's allocation, just with more time. Your employer can only offer one of these options, or neither.

Making Your FSA Work for You: A Proactive Approach

Don't let the FSA downsides and 'use-it-or-lose-it' rules deter you from leveraging this valuable tax-advantaged account. Instead, approach it with a proactive, informed strategy. The key is careful planning, diligent tracking, and understanding your options.

1. Estimate Conservatively, Spend Strategically:

It's usually better to under-contribute slightly than to over-contribute significantly and lose a large sum. Aim for an amount you're highly confident you'll spend. As the year progresses, keep a close eye on your balance. Don't wait until November to start thinking about spending down your funds.

2. Maximize Your Employer's Mitigation:

If your employer offers a carryover or a grace period, factor that into your planning. A carryover provides a welcome buffer, making the "use-it-or-lose-it" less intimidating. A grace period gives you a few extra months to schedule appointments or purchase eligible items after the official plan year ends.

3. Schedule Preventative Care and Elective Procedures:

Use your FSA to cover routine appointments, dental cleanings, eye exams, and prescription refills. If you've been putting off that new pair of glasses or a dental crown, your FSA funds are a perfect incentive to get it done within the plan year. Don't forget to get that doctor's prescription for eligible OTC items well in advance.

4. Keep Meticulous Records:

Save all receipts for FSA-eligible purchases, even if you use your FSA debit card. In case of an audit or a request for substantiation, you'll need proof that your expenses were eligible. Many FSA administrators offer online portals to upload and track receipts.

5. Understand Your Plan's Specifics:

Every FSA plan can have slightly different nuances. Always read your benefits documentation, check your employer's HR portal, or speak directly with your benefits administrator. This includes understanding the exact dates of your plan year, any carryover or grace period rules, and the full list of eligible expenses specific to your plan.

By taking a thoughtful, engaged approach to your Flexible Spending Account, you can confidently navigate its rules, avoid the dreaded forfeiture, and ensure you're making the most of every pre-tax dollar dedicated to your health and well-being. It's about empowering yourself to be an active participant in your financial health, rather than a passive observer.